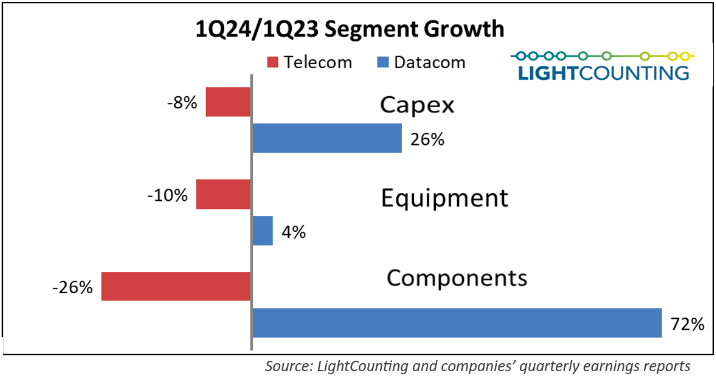

As has been the trend of past few quarters, the first quarter 2024 results for the optical communications market have been stark between very weak sales in the telecommunications space and continued strong demand from hyperscalers. Total capex of the top 15 CSPs fell for the sixth consecutive quarter year-over-year, while spending for the top 15 ICPs grew for the second consecutive quarter, led by Alphabet (+91%) and Microsoft (+66%) growing at a faster pace. ICP spending in China has also increased significantly, suggesting that the AI boom is also hitting China.

Equipment manufacturers may feel like passengers on an airplane have hit airbags, with sales of networking and optical transmission equipment down 10% year-over-year, and server and switch manufacturers up just 4%. Compared to Q1 2023, even smaller, more focused second-tier suppliers like Ciena and Infinera saw consistent declines.

Sales of 400G and 800G Ethernet optical transceivers for deployment in AI clusters are in line with our expectations. Although demand for DWDM began to recover in the fourth quarter of 2023, progress was slow in the first quarter of 2024. Demand for FTTx and WFH transceivers is not expected to recover until 2025-2026. Despite weakness in several segments, cloud demand is expected to increase annual sales of Ethernet transceivers by 40% by 2024, pushing the overall transceiver market to a new high of more than $2.6 billion in the second quarter of 2024. Boiling Light continued to report above-average results, with record sales for the third consecutive quarter.

The semiconductor sector grew 61% year-on-year, driven almost entirely by Nvidia (up 262%), once again highlighting the dichotomy between those who support ICP's AI ambitions and those who support traditional communications providers. Broadcom is worth mentioning (up 43% year-over-year) as its booming data center sales show that the impact of the AI arms race is starting to expand beyond Nvidia.

Looking ahead, we expect ICP spending to continue to grow this year, which will benefit well-positioned vendors such as Nvidia, Broadcom, and Swamp. On the other hand, CSP spending will languish for at least another quarter or two, especially as a drag on large NEMs such as Ericsson and Nokia.

Lanbras is always focusing on creating value for customers and will keep up with the pace of development of the times.

For more information please feel free to contact us info@lanaotek.com