Yesterday, LightCounting d its market forecast for 2024-2028. LightCounting pointed out that starting in the second half of 2022, the demand for optical connectivity began to decline, which led to excess inventory throughout the supply chain. Six months ago, the market outlook for 2023 was bleak, and the financial reports released by mainstream optical module and device suppliers at the beginning of this year showed a significant decline in revenue. The market outlook for the second half of this year and even in 2024 is not optimistic.

While in its last two quarterly reports, Nvidia reported a significant increase in sales of AI hardware, including optical interconnects, which boosted industry morale. Google has increased its investment plans in AI clusters, and many other cloud computing companies have followed. Suddenly, expectations for 2024 are high. Components for 4x100G and 8x100G optical modules are already in short supply.

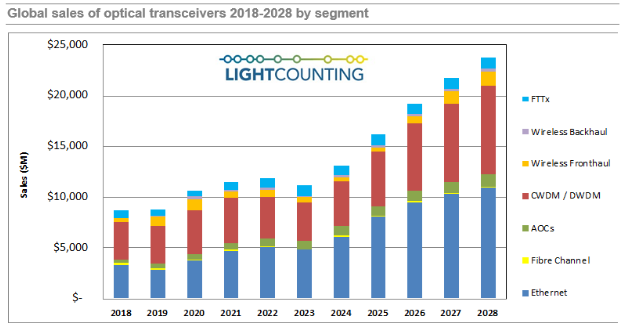

As shown in the t below, it's too late to prevent a market decline in 2023, but LightCounting expects sales of Ethernet Optical Modules to grow by nearly 30% in 2024. All other segments are also expected to recover or continue to grow next year, albeit to a lesser extent. The global Optical Module market is expected to grow at a CAGR of 16% over the next five years, after declining by 6% in 2023.

Amazon, Google, Microsoft, and other cloud computing companies are expected to lead the development of new AI applications. This will require a major upgrade of its AI cluster, which requires the use of a large number of optical connections. The next two years will mainly be 400G and 800G Ethernet Optical Modules and AOC. The upgrade of data center cluster connectivity is also accelerating, which means that shipments of 400ZR/ZR+ and 800ZR/ZR+ will increase from 2024 to 2025.

Cloud computing companies have achieved high growth over the past few years, but as growth slows, they have had to reuate their plans at the end of 2022. Capital expenditures for cloud computing companies have almost doubled between 2019 and 2022, but investments are now more conservative. Capex for the top 15 ICPs is expected to grow by just 1% in 2023, essentially flat after several consecutive years of double-digit growth.

However, AI Infrastructure Investment remains a priority in 2023 and will account for a larger share of total capital expenditure. Barring a recession, LightCounting expects cloud computing companies to stabilize their investments in 2024 and beyond maybe over 10% Growth.

Telecom Service Providers plan to reduce capital expenditures by 4% in 2023. From 2024 to 2028, CSPs are unlikely to see a surge in capital expenditures as they struggle to find new revenue streams. The deployment of 5G hasn't changed that, at least not yet.

Cloud migration for enterprises and consumers is a new priority for telecom operators. Large enterprises can set up private clouds, but consumers and small and medium-sized businesses must rely on telecommunications networks. This presents a potential opportunity for telecom service providers to provide low-latency cloud broadband connectivity to a wider range of customers and generate additional revenue. Supporting these services requires ongoing investment in access and metro networks.

Lanao Communication has been dedicated to the industrial communication field for years, developed self-owned software, and launched thousands of products with six main product lines - Data Center, Industrial Ethernet, PoE Ethernet, Media Conversion, IoT Monitoring, and Optical Transceivers, which have been widely used in industries of Smart Grid, Rail Transit, industrial network security, Automation Manufacturing and so on.

Our core edge is private, tailored, and qualified data tests which help our customers to have value-added products without homogeneity competition.