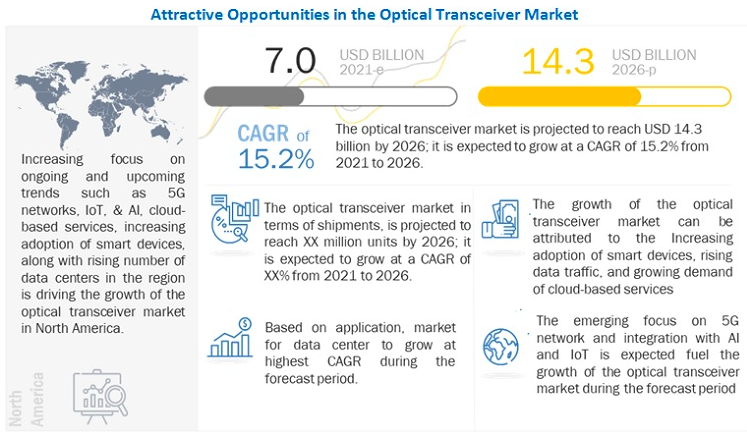

The market has a promising growth potential due to several driving factors including, increase in adoption of smart devices and rising data traffic; rise in demand for compact and energy-efficient transceivers; and growth in the importance of mega data centers, for longer reach and high rates of data transmission with efficient power consumption.

Impact of COVID-19 on current optical transceiver market size and forecast

The emergence of the COVID-19 pandemic, a deadly respiratory disease that originated in China, is now become a worldwide issue and has also affected the optical transceiver market. Most optical transceiver manufacturers have been affected by this crisis, which is expected to be a medium-term impact. This is mainly due to the temporary halt in operations of several well-known companies based in China such as Baidu, Alibaba, Tencent (BAT) and they also operate data centers out of the country and globally. US, with a large number of data centers by players such as Amazon, Facebook, Microsoft, and Apple, is another important country that is severely affected by COVID-19 and businesses are struggling. COVID-19 is expected to have a short-term impact on companies based in China, with the country having been under lockdown across various countries across Asia Pacific, Europe, North America, South America, and RoW. As a result, market players have recorded a drop in sales.

- For instance, due to the COVID-19 epidemic, Facebook (US) halted building on its new, USD 750 million data center in Alabama, as well as the expansion of data centers in Ireland in March 2020.

- In their annual report 2020, optical transceiver OEMs such as Broadcom (US), Lumentum (US) Amphenol (US) and II-VI (US) agreed that the COVID-19 epidemic has impacted their production facilities around the world, as well as disrupted their supplies from the reliable suppliers.

Market Dynamics

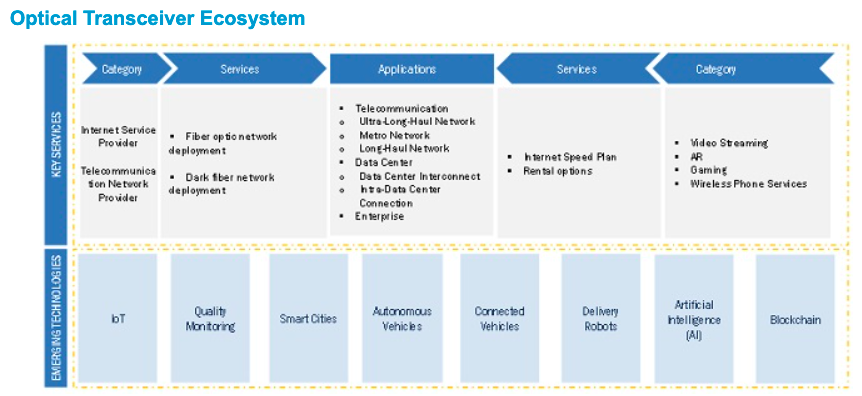

Driver - Growth in demand for cloud-based services

Cloud computing is the process of storing data over the internet and accessing it over a remote server. The users can access data anytime, thus saving substantial capital costs in infrastructure and deriving huge benefits in business. There has been an immense growth of cloud computing applications in the field of consumers as well as business applications over the past few years. The increase in internet data traffic and rising demand for smartphones and other smart gadgets are driving the growth of cloud-based services, hence increasing opportunities for the optical transceiver market. This is mainly due to the assured reliability cloud computing provides as compared to in-house servers. The presence of cloud companies such as Amazon (US), Microsoft (US), and Google (US) speed up the market for optical transceivers for achieving higher bandwidth and faster data rates in order to manage huge amounts of data.

The advent of cloud computing has generated new business capabilities and opportunities for enterprises. With the help of cloud-based services such as software as a service (SaaS), platform as a service (PaaS), and infrastructure as a service (IaaS), small enterprises and consumers can subscribe to a range of services by replacing locally housed computing solutions. Considering cloud computing is no more a disruptive technology and has become common in the organization, software as a service (SaaS) is an emerging cloud-based service with multiple perks of ease of use. With cloud computing, a user is able to customize and manage any software application on a server that is hosted remotely by a third party such as AWS by Amazon (US) and the users are granted access to their data on those servers via the internet. However, with SaaS, the user only needs to pay a subion in order to access an already developed, cloud-based software application via the internet. This eliminates the software maintenance responsibility on the users’ end. A few examples of SaaS include Salesforce, Microsoft Office 365, Amazon Web Services, Zoom, and Slack.

On the other hand, large enterprises and data centers use private clouds to consolidate their own resources and public clouds to accommodate peak demand solutions. In April 2016, Green Computing Consortium (GCC) was introduced in China, a collaboration between cloud solution providers, servers, and academic institutions to develop big data, Advanced RISC Machine (ARM) architecture platform-based enterprise, and cloud computing applications. Companies involved in GCC include Baidu (China) and Alibaba (China). As of 2019, GCC focused on emerging acceleration applications of machine learning and 5G wireless technology. So, by leveraging this technology, data center, and telecom operators can adapt quickly as per changing user demands and provide more efficient solutions using optical transceivers. Also, according to GSMA report 2020, most of the value gain for telecommunication and cloud firms supplying enterprise clients will be in the applications/platform layer, which accounted for the largest share of total IoT in terms of value in 2019 and is further expected to account for 67% share of the total USD 1.1 trillion IoT revenue by 2025. For this reason, the growing demands of cloud-based services are one of the important drivers of the optical transceiver market.

Restraint - Increase in network complexity

Multiple protocols, platforms, and consistent need for the compact network have resulted in the growing usage of connectivity ICs. With time, the transceiver ICs have become more compact and efficient. However, as hardware and software both play a key role in the emerging infrastructures, such as the Internet of things (IoT) and the adoption of open-source platforms through the cloud, the network demands more compactness. These compact modules require drop modules for multiplexing and demultiplexing, variable optical attenuators, and tap power monitors in a single compact unit for network monitoring and control. In addition, the increasing connectivity speed and high-bandwidth connections over fixed and wireless networks have resulted in increased complexity of the network.

Data center networks comprise several layers, including the core, spine (distribution layer), and leaf (access layer). Transceivers are distributed across these layers. Because the switches in these layers are frequently swamped with data traffic, the receiver units of transceivers may experience delayed data packet delivery. All these factors generate a need for more compact form factors to enable compatibility and increase space inside the network. The current network infrastructure is fragmented, focused more on domain-specific growth than the consumer-centric joint approach. The companies need to adopt an innovative and network-oriented approach to minimize the network complexity, which acts as a restraint for the growth of the optical transceiver market.

Opportunity - Introduction of 800G optical transceivers for extended wavelengths over longer distances without regeneration

The emergence of 800G optical transceivers and extensive R&D activities are expected to drive the market considering the demand for faster data rate transmission amid the COVID-19 pandemic and work-from-home culture. The rising demand for higher bandwidth resulted in the reduction of costs associated with component fiber (PSM4) and many other components (including PSM4 and CWDM4). Among the 800G transceivers, the QSFP modules have gained significant importance because of their low power consumption and high density. A transceiver MSA group that includes Cisco (US), Broadcom (US), Juniper (US), Intel (US), and others believes that the pluggable form factor is an excellent choice for data center connectivity. In the first quarter of 2020, this organization released the first version of the 800G QSFP Double Density (QSFP-DD800) pluggable optical transceiver connector and case system standards, defining the 800G optical transceiver form factor, QSFP-DD800. The QSFP-DD800 supports 8 high-speed electrical interfaces connecting to the host, with each lane capable of 100G/s. Furthermore, it is backward compatible with previous QSFP-DD or QSFP modules such as QSFP+, QSFP28, QSFP56, and 400G QSFP-DD, giving network operators significant commercial and operational advantages during the 800G network deployment.

Companies such as II-VI (US) announced 800G QSFP modules, whereas Source Photonics (US) announced a Suite of 800G QSFP & OSFP optical transceivers. InnoLight (China) and Eoptolink (China) offer 800G QSFP as well as OSFP module optical transceivers. Ciena's (US) WaveLogic 5 Extreme supports line rates ranging from 200Gbps to 800 Gbps in 50G increments, allowing operators to achieve maximum capacity for any link in the network using a single technology, from short-distance terrestrial links to Trans-Pacific and over 10,000 km (6,213.7 miles) subsea links. As of November 2020, NTT Communications (Japan) will deploy a single-wave 800G line speed solution for data center interconnect (DCI) based on Ciena’s (US) optical technology that will enable the first 800G ultra-high-capacity network for DCI in Japan. With an 800G solution, network operators, service providers, and content providers can transport more throughput per wavelength deployed or extend wavelengths over longer distances without regeneration.

When compared to 200G and 400G Ethernet, 800G is a relatively new technology. However, as the demand for higher bandwidth networking equipment and connections grows in cloud expansion and hyperscale data centers, 800G optical modules and transmissions will be unavoidable trends in the next 3 to 5 years.

Challenge - Device compatibility and sustainability issues

Optical transceivers are frequently integrated with laser diodes and signal decoders. The transceiver operates between the transmitter and receiver using optical pulses generated by laser diodes and electric signals decoded by signal decoders. Fiber optic cables and devices are compatible with this phenomenon. However, many data centers use copper-based networking devices that are incompatible with fiber optic transmission. In some cases, optical transceivers should be strategically integrated. This is where optical transceivers face difficulties with device compatibility.

Another major concern with optical transceivers is sustainability. Because of the complexity and high-temperature generation in data center networks, optical transceivers' sustainability is a major challenge. Because optical transceivers are sensitive to dust particles, moisture, and high temperatures, they must be built to withstand these conditions. As a result, a lack of sustainability may result in an abrupt network failure

FTTx protocol to witness highest growth rate during the forecast period

The market for FTTx protocol is expected to grow at the highest CAGR during the forecast period. This growth can be attributed to the increasing number of smart homes and the growing demand for high-speed internet connectivity for smart devices, which are expected to be adopted in smart homes globally during the forecast period. The primary advantage of FTTx (such as fiber to the building (FTTB), fiber to the office (FTTO), fiber to the home (FTTH)) is that it can provide unlimited bandwidth with a long reach. With the advancement of technology, video applications such as video streaming, IPTV, high-quality video conferencing, smart home technology, IP video home surveillance, and smart gaming devices are gradually infiltrating customers’ daily lives, resulting in an increase in people's demand for bandwidth. Hence, the market for optical transceivers operating over FTTx protocol is expected to grow at the fastest CAGR during the forecast period.

Optical transceivers supporting data rate of 41 Gbps to 100 Gbps are estimated to grow at the fastest rate throughout the forecast period

Optical transceivers supporting data rate 41 Gbps to 100 Gbps is expected to grow at the highest CAGR during the forecast period. The rising demand for higher data transmission drives the growing demand for 100G, 200G, and 400G transceivers. With the advent of advanced technologies such as AI and 5G, there is an increased requirement for higher bandwidth, which is eventually necessary for data center applications. There has been an increase in internet penetration traffic owing to different factors such as high-bandwidth applications, enhanced data transfer capabilities, fast fixing broadband speeds, growing online video content, mobile internet users, and the proliferation of connected devices. Furthermore, the rising adoption of smart devices and IoT is responsible for the increasing demand for high data rate-enabled optical transceivers along with the shift toward cloud storage. These are some factors leading to the rise in demand for high data rate transceivers for communicating the data efficiently. The rapid expansion of data centers that support streaming videos, cloud services, social networking, and online commerce is another factor fueling the growth of the market. It has been observed that many large-scale enterprises are now increasingly dependent on cloud services. . Optical transceivers in the range of 41 Gbps to 100 Gbps and more than 100 Gbps are becoming predominant among global cloud service providers, such as Amazon, Facebook, Google, and Microsoft. Owing to these advancements, it is evident that the increase in data rates across hyperscale data center applications will drive the growth of the optical transceiver market for 100 Gbps and more than 100 Gbps data rates.

The transceivers operating across 1310 nm bandwidth, are projected to grow at the fastest rate during the forecast period

The transceivers operating across 1310 nm are expected to grow at the highest CAGR during the forecast period due to factors such as lower level of scattering and high data transmission rates with improved accuracy and security. Additionally, the 1310 nm bandwidth level is designed to perform at higher operational temperatures at lower power and reduced cost. Single-mode fibers can be optimized for 1310 nm wavelengths. The fiber optic attenuation is much lower at this wavelength. Optical transceivers operating across the 1310 nm bandwidth support high-speed data transmission. At this wavelength, the absorption losses are minimal. Hence, the growing demand for high data rate transceivers for high-speed computing across data center applications drives the growth of the market to a great extent. The CWDM (Coarse Wavelength Division Multiplexing) optical module can be implemented for the 1310 nm wavelength, which provides the benefits of high flexibility, economy, and reliability of networking. It greatly saves optical fiber resources and reduces the construction cost. Transceivers operating across the 850 nm bandwidth held the largest share in 2020. Factors such as lower attenuation generated by this band and data accuracy contribute to the growth of this market.

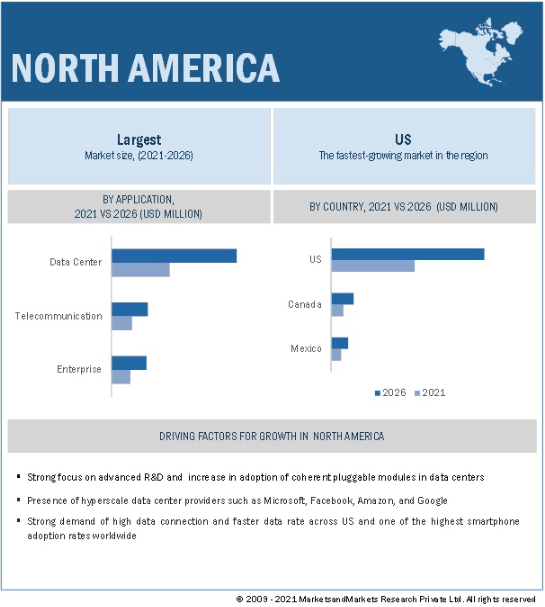

North America to account for the largest share in the optical transceiver market in 2021

North America accounted for the largest share of the optical transceiver market in 2020. The market in North America witnessed a revenue drop of ~5% between pre-COVID-19 and post-COVID-19 scenarios. The market is driven by developments in optical transceivers by North American companies such as II-VI, Lumentum, Broadcom, Mellanox (now a part of Nvidia (US)), NeoPhotonics, Reflex Photonics (now a part of Smiths Interconnect (UK)), Cisco, and Ciena to list a few. These companies replenish the growing demand for specialized optical transceiver modules, such as coherent pluggable modules, bidirectional (BiDi) modules, QSFP modules with a distance range of more than 2,000 km, and ultra-high-speed 800G optical transceiver modules for telecommunication, data center, and enterprise applications. The presence of five major cloud providers’ R&D headquarters across the US, which are Microsoft, Google, Amazon, Facebook, and Apple, has enhanced the growth of the data center market and, consequently, the optical transceiver market to a substantial extent.

The recent COVID-19 pandemic is expected to impact the global optical transceiver industry. The entire supply chain is disrupted due to limited supply of parts. The US is the largest market for optical transceivers with a huge base of global players, including II-VI, Broadcom, NeoPhotonics, Lumentum, Smartoptics, Infinera, Ciena, Cisco, and Applied Optoelectronics. The huge knowledge base, expertise, and R&D can also be considered important factors for North America being the least impacted region due to COVID-19. However, the pandemic impacted the demand and supply in the market. Companies such as II-VI (US), Broadcom (US), and Lumentum (US) accepted the halt and disruption in both demand and supply sides.

Key Market Players

Major vendors in the optical transceiver market include II-VI (US), Broadcom (US), Lumentum (US), Sumitomo Electric Industries (Japan), Accelink (China), Smartoptics (Norway), Infinera (US), Fujitsu optical Components (Japan), Hisense Broadband (China), Huawei (China), Innolight (China), Ciena (US), Mellanox (US) (the company was acquired by Nvidia in April 2020), Applied Optoelectronics (US), Amphenol (US), Intel (US), NEC (Japan), Cisco (US), NeoPhotonics (US), Perle Systems (Canada), FOCI (Taiwan), Source Photonics (US), Eoptolink (China), and Reflex Photonic (Canada) (the company was acquired by Smiths Interconnect (US) in November 2019). uSenlight (Taiwan), and Precision Optical Transceivers (US), POET Technologies (US), ProLabs (US), Elenion Technologies (US), HRB Technologies (India), and Alpine Optoelectronics (China) are few startup companies that provide such type of transceivers.