Intersec Dubai - The world’s leading trade fair for security, surveillance and fire protection.

INTERSEC DUBAI 2025

JAN 14–16 2025

Dubai World Trade Center

Intersec will mark its 26th edition from 14–16 January 2025 at Dubai World Trade Centre following a huge international response from both visitors and exhibitors attending its Silver Jubilee event in 2024 which hosted 47,506 trade buyers from 141 countries including key government leaders, agencies and organisational heads across industries.

The dynamics of the market are constantly evolving with new technologies such as blockchain, AI and IOT having a significant impact across the safety and security industry. This leads Intersec to be the event where experts, suppliers and buyers in the world of security, safety and fire protection meet face to face to discuss leading-edge technology, witness the very latest products and solutions across a wide range of industries and business sectors, and conduct business.

Intersec 2025 is held under the patronage of HH Sheikh Mansoor Bin Mohammed bin Rashid Al Maktoum. It is divided into 12 showrooms, you can find services from many product groups, such as surveillance systems, surveillance, video management, and analytics systems.

INTERSEC DUBAI 2025: INNOVATION AT THE HEART OF SECURITY

Intersec Dubai is an important trade event that brings together different industries. From security solutions in the financial sector to aviation security screening systems, from building security and construction projects to various system technologies used to protect schools, hotels, ports, logistics companies, shopping malls, hospitals, and government agencies, Intersec 2025 in Dubai brings together services in many areas. The event brings together industry leaders and professionals to discover the latest innovations and solutions in the field of security.

The show will showcase the latest innovations and solutions in the fields of homeland, cyber, commercial security, safety and health, and fire and rescue through high-quality PoE products and services offered by national and international exhibitors. When you register for Intersec online, you automatically have access to a free business matching program, meet with exhibitors important to your business, and schedule private meetings before the show. An exclusive program called "The Premium Club" offers elite buyers and influencers from specific industries the opportunity to enjoy free benefits during their visit to Intersec and is open by invitation only. There will also be easy navigation and interaction via the Intersec mobile app throughout the show.

STATISTICS OF INTERSEC DUBAI

43,305 visitors from 131 countries came together in 45 thousand square meters of exhibition area.

Over 800 exhibitors from 55 countries participated in the exhibition.

There were 200 new companies participating in the fair. This shows that the recognition of the fair is increasing every year.

Eleven countries had national pavilions, including the Czech Republic, Germany Italy and Turkey.

The UK was the largest international exhibitor with 77 companies.

There were 114 conference events with over 150 speakers.

Leading brands such as Bosch, Bristol, Dell, Motorola, 3M and Bristol Bristol were also present.

THEMES

Key themes to be discussed at the event include:

Commercial & Perimeter Security

Homeland Security & Policing

Fire & Rescue

Safety & Health

Cybersecurity

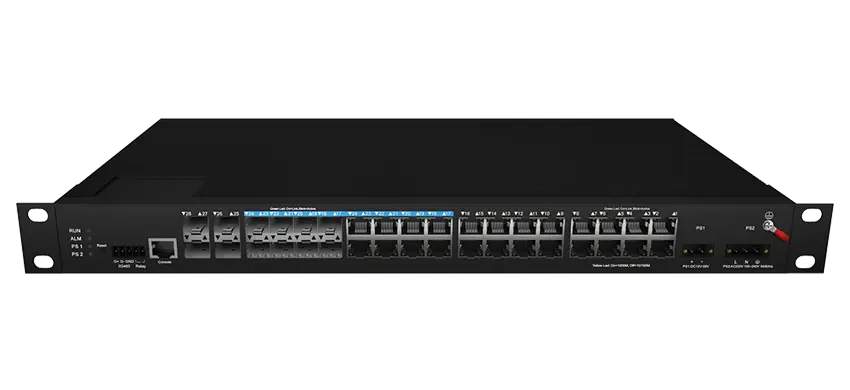

Lanao Communication has been steadfastly committed to designing, developing, and manufacturing state-of-the-art Optical and Ethernet Transmission solutions. Our mission is to foster a more interconnected world through efficient, sustainable, and transformative communication technologies.

We provide a comprehensive product portfolio spanning key sectors such as PoE Switches, CCTV Security System, Industrial Networking, IoT, Smart Cities. Collaborating with enterprises, carriers, system integrators, telecom operators, ISPs, and distributors worldwide, we deliver solutions that prioritize cost efficiency, service excellence, and environmental sustainability.

To learn more about Intersec 2025, to register to attend or exhibit, please feel free to contact our service team to help you support@lanaotek.com Or meet with our expert in Dubai

Whatsapp: 0086-15818596950

Email: jennifer_z@lanaotek.com

Internet Data Center

Internet Data Center FAQ

FAQ Company News

Company News About Us

About Us Data Center Switch

Data Center Switch  Enterprise Switch

Enterprise Switch  Industrial Switch

Industrial Switch  Access Switch

Access Switch  Integrated Network

Integrated Network  Optical Module & Cable

Optical Module & Cable

Call us on:

Call us on:  Email Us:

Email Us:  Room 2106, 3D Building, Tianan Yungu Industrial Park, Xuegang Road No.2018, Bantian, Longgang, Shenzhen, P.R.C.

Room 2106, 3D Building, Tianan Yungu Industrial Park, Xuegang Road No.2018, Bantian, Longgang, Shenzhen, P.R.C.